Spoiler Alert: Printing glossaries and grids isn’t among them

You put so much time and effort into your open enrollment (OE) program. So why are employees still confused and unengaged? All too often, we’ve seen employees mount a search to uncover the “best” plan – as if there is some “best” plan hidden in that grid.

In many cases, employees equate the “best” plan with the plan that has the highest monthly premium and the broadest provider network. But is the “best” plan actually “best” for them? Far too often, the answer is no.

On the other end of the spectrum, employees in lower salary brackets often choose the “cheapest” option, typically a high deductible health plan (HDHP). This is also concerning, given studies show that high deductibles lead people to skip necessary care due to out-of-pocket costs, potentially causing distress and worsening health issues.

These decision paths point to the same fact: many employees aren’t selecting the best health plan for them.

You can help change that.

Here are four steps to guide employees toward making informed, logical decisions about their benefits:

- Outline the key factors they should consider when choosing a plan

- Do the math for them

- Emphasize crucial coverage details, especially for high-cost services.

- Make it easy to involve their spouse/partner in the decision-making process

Here’s a closer look at each one.

Step 1: Outline the key factors they should consider when choosing a plan

Start with the fundamentals. A quarter of all insured adults say they have difficulty understanding specific terms, such as “deductible”, “coinsurance”, or “allowed amount”. That’s a problem when employees are supposed to comparison-shop for health plans.

Too often, employers provide a glossary of terms and think the education is done. Beyond defining the terms, you can show employees how to evaluate a plan using the following steps:

Too often, employers provide a glossary of terms and think the education is done. Beyond defining the terms, you can show employees how to evaluate a plan using the following steps:

- Evaluate the network options. Different plans offer varying networks of doctors. Plans with a “broad” network include nearly all doctors, but typically cost more. Other plans may use a tailored network of pre-screened providers based on quality or cost-effectiveness, often at a lower cost. Review the plan’s provider directory to see which doctors are included. If you’re undergoing treatment or have a preferred provider, this could be a crucial factor in your decision.

- Know the rules. Does a plan require you to pick a primary care doctor? Get referrals? How does the plan help you do these things? And does this matter to you? If so, at what cost?

- Determine what type of support you’ll have during the year. Can you easily find information about your coverage or what you owe? How can you get answers to your questions? Is there an app that can provide you with that information?

- Calculate your total cost over the year. Review your out-of-pocket costs, including the payroll deductions for each plan. Consider your and your family’s anticipated care needs for the year and estimate the associated costs. Be sure to include at least one annual primary care appointment and any ongoing specialist visits.

Step 2: Do the math for them

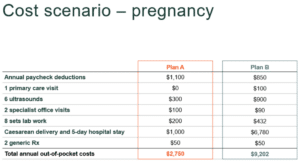

For most employees, calculating out-of-pocket costs can be difficult, especially if a plan has a deductible and coinsurance. It’s important to show your employees examples of their costs for each plan. Illustrate different healthcare utilization scenarios and associated costs between your company’s health plan offerings. Here’s an example:

Tables like these make it easy for employees and their families to compare plan options and estimate their anticipated costs for the coming year.

Step 3: Emphasize crucial coverage details, especially for high-cost services

The benefit grids used during OE often miss important details, such as coverage for mental health, women’s health, surgeries and specialty drugs. They also leave out life-changing items like infertility treatment and childbirth and key info about the plan’s network or rules. One solution is developing personas that help employees visualize how different plans can meet their needs and preferences.

For example, Miles, 25, doesn’t have a primary care doctor and visits urgent care if he needs medical attention. What’s going to entice him to get preventive care so he doesn’t end up in the ER suffering the effects of an undiagnosed condition? Show what Miles would pay for primary care and his out-of-pocket savings.

Or Jen, 31, who covers four children on her medical plan and worries about how she will pay for pediatrician visits if they get sick or injured. Show the coverage each plan offers in terms of pediatric care or the cost for a newborn delivery for those looking to start a family.

Tables like these make it easy for employees and families to compare plan options and estimate their total costs for healthcare over the coming year. As a bonus, they can use these totals to plan for savings as well.

You should also encourage employees with high-deductible plans to set aside money through an HSA or savings account. Why? Because according to a recent study, 1 in 4 Americans faced healthcare payment issues in the past year, and nearly half couldn’t cover an unexpected $500 medical bill without going into debt.

Step 4: Make it easy to involve their spouse/partner in the decision-making process

Because very often people choose health plans for the whole family, it’s important to make it easy to involve all of the decision-makers. How can you involve a family’s healthcare decision-maker if they’re not your employee? Some options include:

- Recommend to employees that they discuss plan options with their families before selecting a plan

- Send OE materials by email so they can be forwarded to family members

- Consider sending postcards or a mailer to employees’ homes

- Host webinars during evening hours and send invites with a message that it’s open to family members

- Record your webinars and share links to recordings

- Collect contact info for adult family members during enrollment, so they can receive communications directly from the health plan

OE is just the start

These four steps help employees make informed decisions about choosing the “best” health plan, which should be re-evaluated annually. But OE is just the beginning – guiding employees on how to maximize their plan is equally important.

First, encourage everyone to form a relationship with a primary care doctor so they have a point of contact before they need care.

Educate employees on the value of preventive care year-round, and incorporate reminders into your ongoing communications, timed with national awareness weeks and months for added relevance.

Finally, work with your health plan or third-party administrator (TPA) throughout the year to ensure members get the support they need. Ensure employees have access to an app or online portal with all their coverage details and responsive customer service.

By offering clear and thoughtful guidance starting in open enrollment, you can empower your employees to collaborate with their families to choose health plans that fit their healthcare needs and budgets.