Spoiler Alert: Printing glossaries and grids isn’t among them

You put so much time and effort into your Open Enrollment (OE) program. So why are your employees still confused and unengaged? All too often, I’ve seen employees mount a search to uncover the “best” plan, as if there is some “best” plan hidden in that grid.

In many cases, employees equate “best” plan with “plan with the richest benefits”. This usually means the highest monthly premium and the broadest provider network. But is the “best” plan actually “best” for them? Far too often the answer is no.

Equally troublesome is that there are employees, particularly those toward the lower end of the pay scale, who tend to pick the perceived “cheapest” option, which more often than not is a high deductible health plan (HDHP). But numerous studies have found that high deductibles cause people to skip the care they need due to out-of-pocket costs – which of course can cause distress and eventually even more serious health issues.

Both of these decision paths point to the same fact: that many employees aren’t selecting the health plan offerings that are best for them.

You can change that.

As your open enrollment period nears, here are four steps to make the decision path as logical and beneficial as possible to your employees, your company and you:

- Explain the variables they should consider when determining the right plan

- Do the math for them

- Highlight important aspects of coverage, especially for big-ticket items

- Make it easy to include their spouse/partner in the decision

</ul style=”padding-left: 30px;”>

Here’s a closer look at each one.

Step 1: Explain the variables they should consider when determining the right plan

You really do need to start with the fundamentals. Healthcare Dive found that only 9% of Americans surveyed “showed an understanding” of four basic health insurance terms — health plan premium, health plan deductible, out-of-pocket maximum and co-insurance. That’s a problem when health plan members are supposed to comparison shop for plans.

Too often, we provide a glossary of terms and think our education is done. Beyond defining the terms, you need to show how they apply. Giving employees this structure is great place to start.

- Estimate your total cost over the year – including premiums and out-of-pocket expenses.

- Evaluate which network works for you – different plans often have different networks of doctors that you can see. Plans with a “broad” network will include almost all doctors, and those plans usually cost the most. Others will screen doctors for quality, cost-effectiveness, or both, providing you with a tailored network of pre-screened providers, generally at a lower cost. You can check the plan’s provider directory to see which doctors are in each network.

- Know the plan specifications and rules – do you need to pick a PCP? Get referrals? How does the plan help you to do these things? And does this matter to you? If so, at what cost?

- Determine whether you’ll have the services you need – how are you supported with information in finding care and understanding your coverage and bills? Is there an app that can provide you with that information at your fingertips?

Step 2: Do the math for them

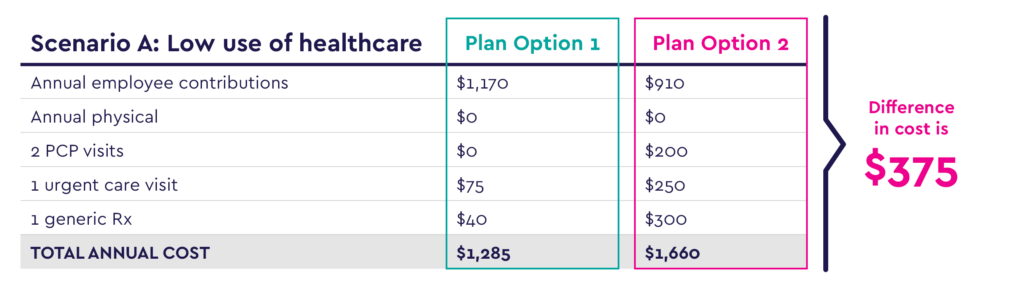

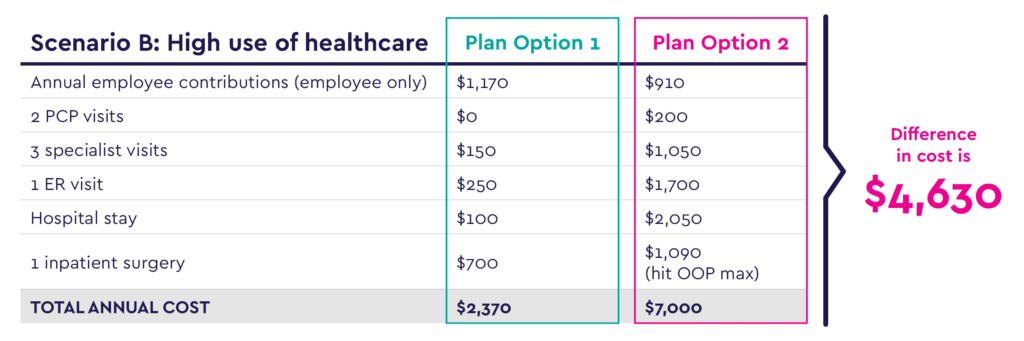

For most employees, figuring out costs is not as easy as it seems to industry veterans. It is critical then to show your employees examples of how to think about annual costs. Illustrate different healthcare utilization scenarios and associated cost differences between the healthcare plans that your company offers. Here’s an example:

Your costs: A year in comparison

Tables like these make it easy for employees and families to compare plan options and estimate their total costs for healthcare over the coming year. As a bonus, they can use these totals to plan for savings as well.

Step 3: Explain coverage, especially for big ticket items

The simple grids we have come to rely on during open enrollment often leave off a lot of important information, such as coverage details surrounding mental health, women’s health, surgeries, specialty drugs and more. In addition, grids often fail to include coverage of big life-changing items that might affect employees and their families, such as infertility treatment and prenatal care/childbirth. They also don’t include important information about the plan, such as the network and plan rules.

One solution is to create personas that help employees see themselves benefiting from the options offered by one plan or another.

For example, Miles, 25, hasn’t seen a doctor in years. What’s going to entice him to get preventive care so he doesn’t end up in the ER suffering the effects of an undiagnosed condition? Show what Miles would pay in out-of-pocket costs for primary care.

Or Sarah, 31, who plans to start a family in the next year. Show the coverage that each plan offers in terms of prenatal care, delivery and pediatric care.

One-page grids look great – but can you honestly say your employees could turn to one and know what to expect during one of the scenarios above?

Step 4: Make it easy to involve their spouse / partner

Because very often people choose health plans for the whole family, it’s important to make it easy to involve other decision-makers. For example, fully 80% of healthcare decisions for families are made by women, according to the U.S. Department of Labor. So how do you engage someone who is not your employee? Some options include:

- Strongly recommend to employees that they discuss plan options with their partner before selecting a plan

- Send OE materials by email (and even hard copies to your employees’ homes)

- Host webinars during evening hours and/or share links to recorded ones

- Collect partners’ contact info during enrollment so they can receive communications directly from the health plan

OE is just the start

These four steps are intended to help employees make more informed decisions about choosing their healthcare plan – a decision that should be re-evaluated every year based on their current or anticipated circumstances. But OE is just the start of the education process. Once people select a plan, it’s important to help guide them to make the most of it.

For starters, encourage everyone to form a relationship with a primary care provider so they have a point of contact before they need care.

For employees who choose plans with high deductibles, urge them to set aside money to cover medical expenses, either through an HSA or another form of savings account. Why? Because according to a study conducted by 20/20 research, 61% of Americans have no money saved to cover healthcare expenses, and 44% would put off medical care if they knew the associated out-of-pocket expenses would be more than $500 – even if it posed health risks.

Work with your carrier or third-party administrator (TPA) throughout the year to ensure members are getting the service they need. Be sure that your employees have an app or online portal that houses all necessary coverage information, as well as access to excellent customer service.

Keep a pulse on your employees’ experience through focus groups, surveys or other measurement tools.

A strong carrier/TPA partner will lead you through these items proactively.

Do these steps sound like they could improve your OE season? Reach out to Centivo to learn how you can offer your employees great new plan options with an OE experience to match.