With rising inflation, the cost of just about everything is going up – including how much you pay for healthcare through your company plan. One way you might have tried to manage costs during these tough financial times is to choose the lowest-premium health plan. This way, you pay the least amount for healthcare coverage each paycheck and hope you won’t need to pay much for care during the year.

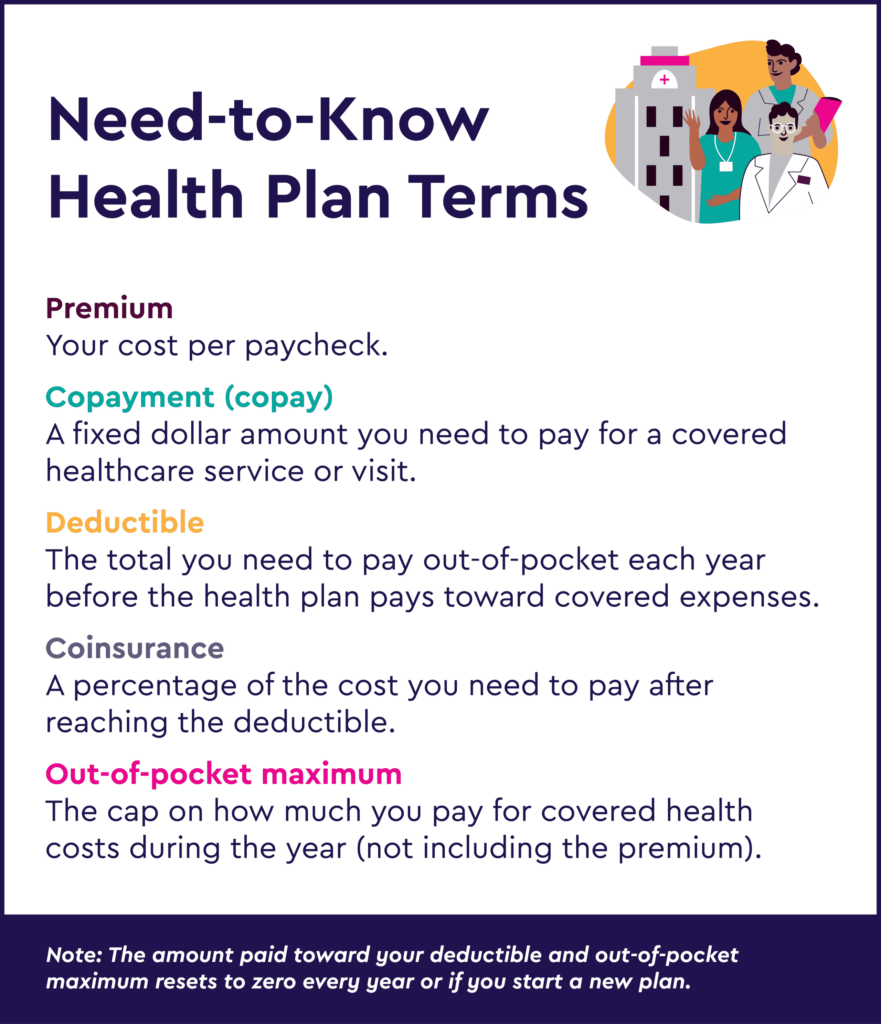

But that’s a risky approach, especially these days. Low-premium plans usually come with a high deductible, which is an amount you need to pay before your healthcare plan covers your medical expenses. This usually ranges from several hundred to several thousand dollars, so any care you use could come with an unexpected and possibly whopping bill. During open enrollment, look at all the costs you may be responsible for if you need care – like your deductible, copay and coinsurance – not just what’s taken out of your regular paycheck (see the graphic for definitions).

The good news: Choosing an affordable, high-quality plan to fit your family’s needs and budget doesn’t have to be a risky guessing game. With a Centivo health plan, there are no surprises. There’s no deductible, free primary care and low copays for other types of care. This means you always know what your costs will be, if anything, before a visit – and that you won’t end up with a large surprise bill after leaving your doctor’s office.

With no end in sight for cost increases in healthcare and all other aspects of our lives, you owe it to yourself (and your bank account) to take a harder look at your benefits options and make the most of every hard-earned dollar this open enrollment season. And, if your employer offers a Centivo option, this is a particularly good year to see how this easy-to-use plan with high-quality providers can save you and your family money.