Buffalo, NY, November 30, 2021– A recent Centivo survey of employees with employer-sponsored health insurance asked respondents if they had incurred significant medical expenses in the past two years. The disturbing answer: more than one quarter (27%) who did say those expenses had a major impact on their mental health, while 16% indicated they had a major impact on their family’s well-being. These results come from a preliminary analysis of the Centivo Healthcare and Financial Sacrifices Survey, 2021. Centivo conducted the survey in August 2021 among 805 US adults ages 18-64 with employer-sponsored private health insurance.

These findings come at a time of intense interest and scrutiny from US employers surrounding mental health issues among workers. According to a 2021 Mercer survey, employers with 500 or more employees say that that addressing employees’ mental and emotional health will be a top priority over the next 3-5 years1. The Kaiser Family Foundation also found that four in 10 (39%) employers report making changes to their mental health and substance abuse benefits since the beginning of the pandemic2.

“US employers are rightly concerned about the mental health of their workforce during this time of immense societal changes and disruptions caused by the pandemic,” said Dr. Wayne Jenkins, Chief Medical Officer, Centivo. “We urge employers, however, to not just tack on yet another solution to their already overloaded benefit plans, but to first examine some root cause affordability issues inside their core health plans and what impact these issues have on rising mental health problems among workers.”

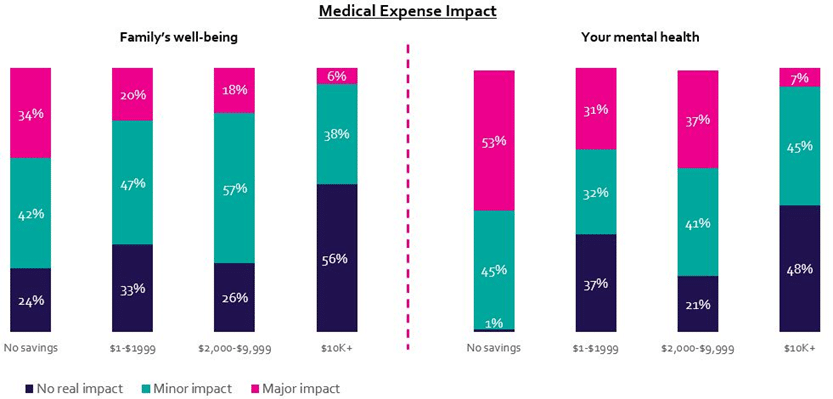

The need for employers to reassess overall health plan affordability is further underscored by the Centivo survey finding that the less respondents had saved, the more likely they are to report that major medical expenses have impacted their mental health. In fact, only when respondents reported more than $10,000 in savings do they also report low levels of mental health and family well-being issues (see Figure 1).

Healthcare affordability also correlates to sacrifices in care, including mental healthcare; a full 20% of respondents who experienced major medical expenses said they skipped or delayed needed mental healthcare/counseling due to cost concerns.

“We believe that foundational changes to the design of an employer’s health plan could have a significant and positive impact in lowering mental health issues,” said Dr. Jenkins. “Such steps as eliminating deductibles, providing simple and predictable copays and making primary care visits free are all realistic improvements that can truly help today’s average American workers who are so vulnerable amid our ongoing healthcare affordability crisis.”

Figure 1: Savings and the impact of medical expense on individual mental health and family well-being

To receive a complimentary Executive Summary of the Centivo Healthcare and Financial Sacrifices Survey, 2021, please complete the form below:

[hubspot portal=”5084039″ id=”d5d3d598-eb5f-4f06-86a2-6c903e4ffd96″ type=”form”]About the Centivo Healthcare and Financial Sacrifices Survey, 2021

Centivo engaged SSRS, a full-service survey and market research firm known for innovative methodologies and optimized research designs, to gain an understanding of the financial sacrifices people must make due to unexpected medical expenses. SSRS conducted the survey in August 11-24, 2021. Responses come from 805 US adults ages 18-64 who have maintained private employer-sponsored health insurance coverage for at least the past two years. Respondents were selected from the SSRS Opinion Panel, SSRS’s Probability-based panel sample, and completed via the web using a self-administered online survey. The margin of error is +/-4.5% for all 805 respondents and +/-8.2% for the questions related to mental health impacts (254 respondents), the margin of error for smaller subsets of respondents will be higher.

About Centivo

Centivo is a new type of health plan anchored around leading providers of value-based care. Centivo saves self-funded employers 15 percent or more compared to traditional insurance carriers and is easy to use for employers and employees. Our mission is to bring affordable, high-quality healthcare to the millions of working Americans who struggle to pay their healthcare bills. With Centivo, employers can offer their employees affordable and predictable costs, a high-tech member experience, exceptional service, and a range of benefit options including both proprietary primary care-centered ACO models as well as traditional networks. For more information, visit centivo.com or follow us @Centivo on LinkedIn or @CentivoHealth on Twitter.

1 Mercer National Survey of Employer-Sponsored Health Plans, 2021. October 6, 2021. Employers expect a 4.7% increase in health benefit costs for 2022 as they focus on improving employee benefits rather than cost-cutting | Mercer

2 Kaiser Family Foundation 2021 Health Benefits Survey. November 10, 2021. Average Family Premiums Rose 4% This Year to Top $22,000; Employers Boost Mental Health and Telemedicine amid COVID-19 Pandemic, Benchmark KFF Survey Finds | KFF

For media inquiries please contact bruce.lee@centivo.com.